The Canadian economy has been experiencing a surge in inflation, causing widespread concern among businesses, consumers, and policymakers. With prices for everyday items such as groceries and gasoline skyrocketing, many Canadians are feeling the pinch and are realizing inflation has been a lot more broad-based.

What’s driving inflation?

One of the main drivers of this current bout of inflation is how the global economy reacted to the COVID-19 pandemic and the spin-off of monetary and fiscal policy responses. Supply chains, business production capacity, and consumer spending were all affected. As economies around the world reopened from lockdowns, prices have gone up due to the mismatch in supply and demand for different goods and services.

The war in Ukraine and the shock it has caused to global energy and food markets has also played a major role in the current surge in prices we’re dealing with.

What’s the Bank of Canada doing?

As one of its main mandates, the Bank of Canada has been forceful in trying to bring inflation back down to their 2% target range. Starting in March 2022, the Bank raised the target for the overnight policy rate by 450 basis points from a low of 0.25% to 4.75%, as of June 2023. This was one of their fastest rate hike cycles on record.

Still, with inflation well above target, it may take more time to slow down price growth. Price increases continue to be widespread, and Bank of Canada officials have stated they’re concerned about the risk of inflation becoming stuck above the 2% target range.

But what exactly does broad-based inflation mean, and how can we hope to get it under control? Let’s look at how prices are increasing in a wider range of everyday goods and services and discuss where the Bank of Canada sees inflation trends going forward.

How do we track inflation and where are we seeing price increases?

Spoiler alert: we’re seeing price increases everywhere.

To construct the Consumer Price Index (CPI), Statistics Canada uses a “fixed basket” of goods and services that represent the typical spending patterns of Canadian consumers. The basket is composed of about 700 different goods and services Canadians typically buy, which are organized into eight major components:

- Food—groceries and restaurant meals, including non-alcoholic beverages

- Shelter—rent and mortgage costs, insurance, repairs and maintenance, property taxes, utilities

- Transportation—vehicles, gasoline, car insurance, repairs and maintenance, public transit costs

- Household operating, furnishings, and equipment—phones, internet, childcare, furniture, cleaning supplies, appliances

- Apparel—clothing, footwear, jewelry, dry cleaning

- Health and personal care—prescriptions, dental care, eye care, haircuts, toiletries, healthcare services

- Sports, travel, education, and leisure—entertainment, school, travel, and reading materials

- Alcohol, tobacco, and recreational cannabis

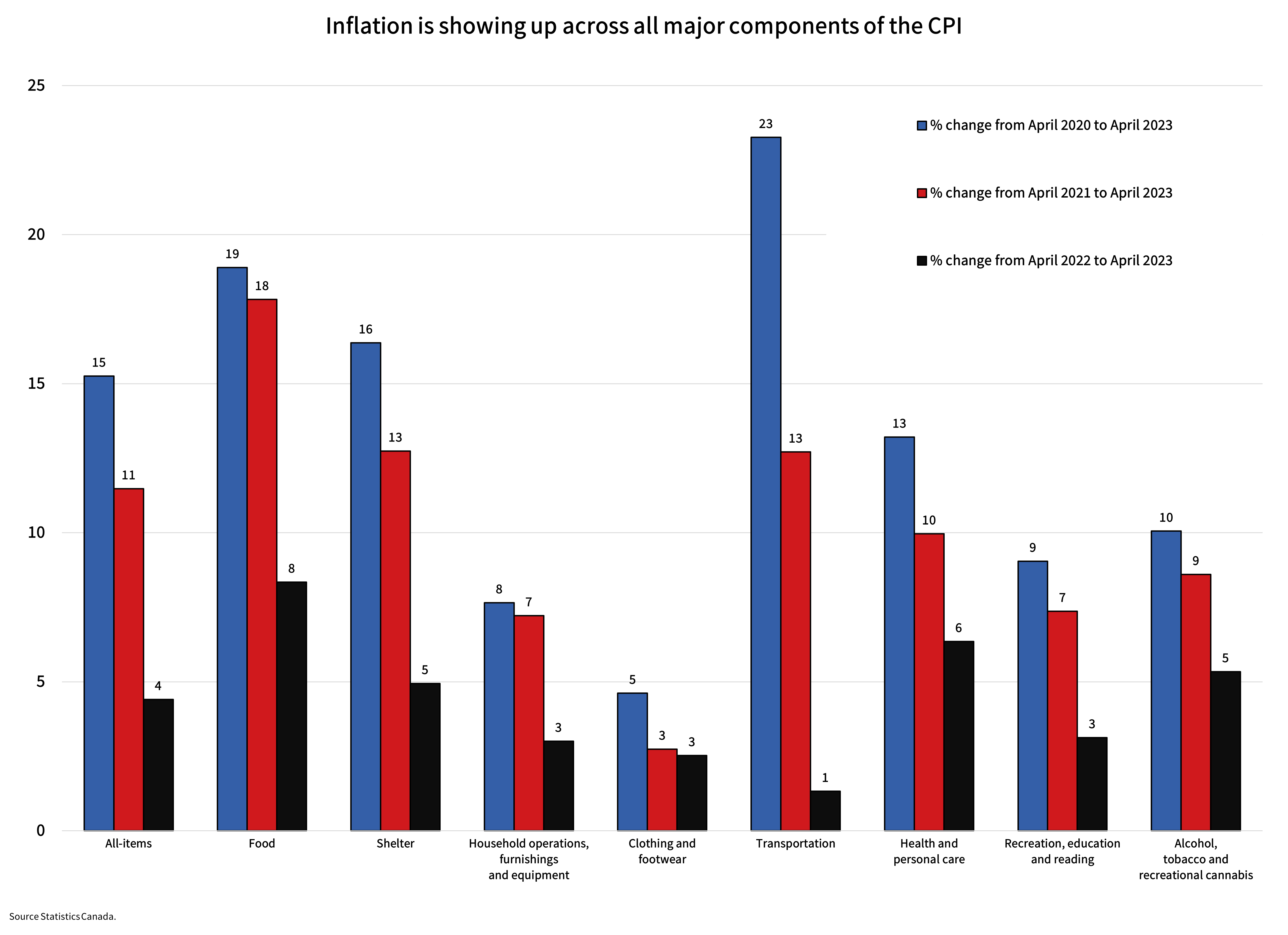

All eight components saw price increases in April 2023 compared to the last few years, indicating inflation is broad-based and not just affecting typical sectors that see major price fluctuations, like food and energy-related goods.

While food, gas, and shelter prices continue to dominate news headlines, more than 80% of all goods and services tracked by Statistics Canada for the CPI are showing price growth above 2%, impacting consumption and spending patterns.

You may also enjoy reading…

- What You Need to Know About Inflation and Real Estate

- Bank of Canada Maintains Overnight Rate

- A Look at the Latest Quarterly Forecast

Should Canadians be worried?

The impact of inflation affects different groups of people in a multitude of ways, and their expectations about future inflation can create further inflation. Recent surveys conducted by the Bank of Canada indicate Canadian businesses and consumers expect inflation will continue to be widespread and for the CPI to be above 2% well into 2025.

Those surveys also find most Canadians think the Bank’s ability to get inflation back to target is being hampered by high government spending and challenges around supply chains.

High inflation and rising interest rates put extra pressure on Canadians, especially those with other long-term debt obligations.

When it comes to the housing market, higher financing costs due to restrictive monetary policy raises mortgage servicing costs for those renewing or getting new mortgages. In 2022, we saw the rapid rise in borrowing costs contribute to a slowdown in housing market activity.

With a bit more certainty on how high rates may need to go, we have started to see housing market activity turn a corner. Still, with higher financing costs, Canadians may have to cut back on other discretionary services such as travel and eating out.