National home sales activity has settled back down in recent months following a brief rally this spring. While the Bank of Canada’s rate hikes in June and July obviously played a factor, it has also been the messaging around how much longer rates would remain high compared to expectations back in the spring. The summer rate hikes also rekindled uncertainty that more were still to come.

In a typical year, housing markets tend to be most active in the spring. This tends to wind down over the summer, but there’s often a bit of an uptick in the fall. That has certainly been true on the new listings side since Labour Day; however, this influx of new supply has not led to an uptick in sales.

As a result, the national sales-to-new listings ratio has fallen from near 70% to 50% in the span of just five months, while the rally in prices has slowed markedly, or in the case of Ontario, reversed.

As a result of these weaker sales and pricing trends since the summer, combined with softer market conditions going forward and “higher for longer” interest rates, the Canadian Real Estate Association (CREA) announced its forecasts for sales and average prices over the balance of 2023 and into 2024 has been lowered.

The major risk to this forecast remains what happens with the data that the Bank of Canada is eyeing and what that means for its key policy interest rate between now and next spring. The current assumption is either no more hikes, or at most one more, along with some indication from the Bank at some point that the next move will likely be down.

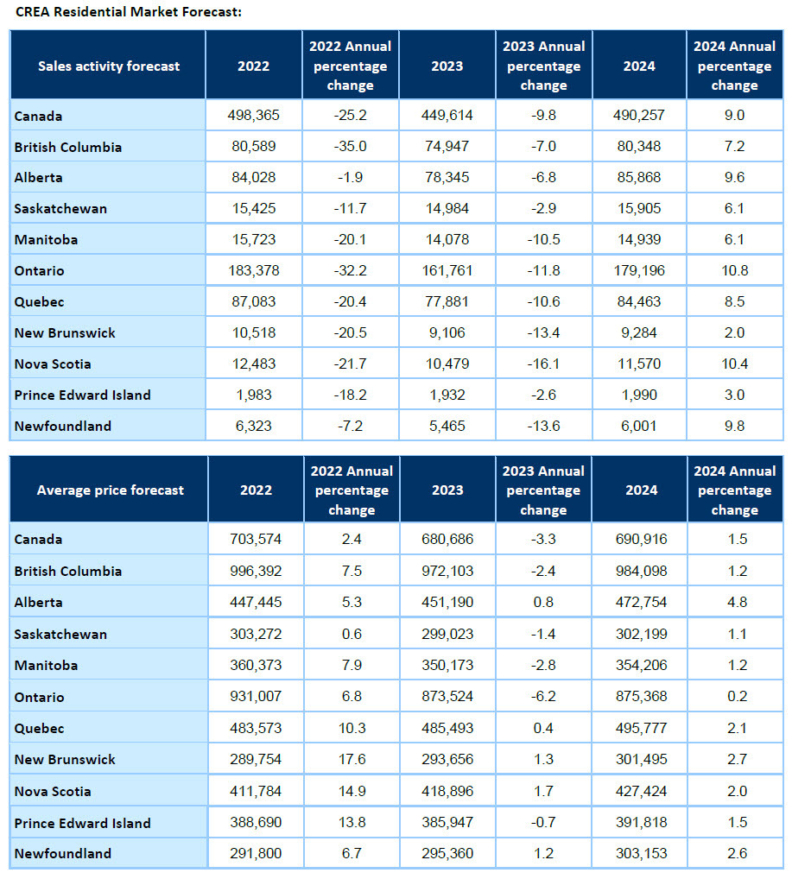

Some 449,614 residential properties are forecast to trade hands via Canadian MLS® Systems in 2023, a 9.8% decline from 2022. Unlike the previous downgrade in July, which was broad-based, the October downward revision to sales was predominantly due to fewer expected sales in Ontario and British Columbia. These more than offset an upward revision to the forecast for activity in Alberta.

The national average home price is forecast to decline by 3.3% on an annual basis to $680,686 in 2023. This is down from CREA’s previous forecast, owing primarily to the compositional impact of lower sales in Ontario and British Columbia, by far Canada’s two most expensive provinces for real estate. Provinces forecast to see small average price gains this year include Alberta, Quebec, New Brunswick, Nova Scotia, and Newfoundland and Labrador.

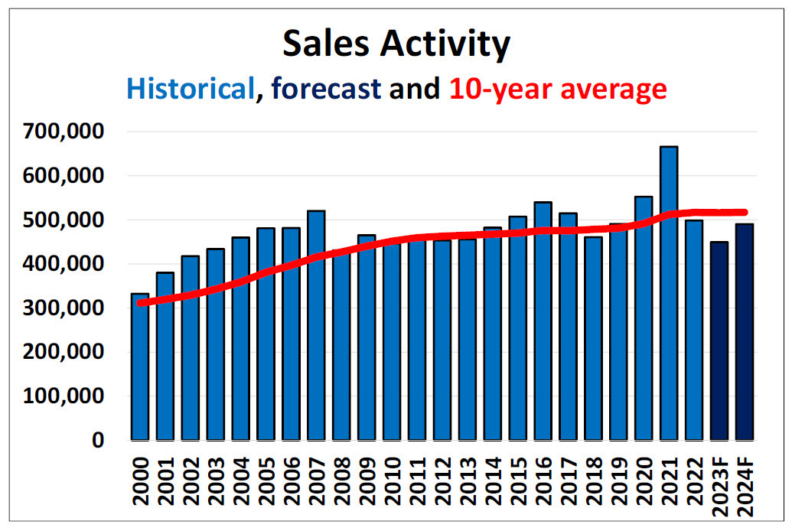

National home sales are forecast to rebound by 9% to 490,257 units in 2024 as interest rates get closer to, and eventually start, trending down and housing markets make a turn back towards their long-term trends. This forecast would place activity close to the pre-pandemic 10-year average, below levels recorded in 2007, 2015, 2016, 2017, 2019, 2020, 2021, and 2022.

The national average home price is forecast to regain a modest 1.5% from 2023 to 2024, coming in at $690,916. Despite a lot of monthly volatility, this forecast would mark the fourth year in a row that the annual national average price has remained in the $680,000-$700,000 range. This is not without precedent. This measure has held stable for that long or longer before, including from 2016-2019, and prior to that, back in the 1990s.

Prices in Alberta are expected to outperform the rest of Canada in 2024, with a forecast gain of 4.8% compared to 2023. In contrast, Ontario is forecast to see virtually no growth in prices next year (+0.2%). Modest price growth in the 1% to 2.5% range is forecast for other provinces in 2024.

You can find more information about Canada’s housing markets by visiting stats.CREA.ca.